Calculate land value for depreciation

June 27 2021 June 26 2021 by Isabella. Find out what the comps are for raw land by acre in the area are and multiply it by the amount.

Depletion Method Of Depreciation Accounting Education Economics Lessons Finance Class

Subtract the estimated salvage value of the asset from.

. How to Calculate Depreciation. This is the remaining. How to Calculate Straight Line Depreciation.

Depreciation expense is meant to compensate a rental property owner for normal wear and tear to the building over a period of time. How to Calculate Salvage Value. Depreciation expresses the loss of value over time of fixed assets of a business.

Regardless of the method used the first step to calculating depreciation is subtracting an assets salvage value from its initial cost. Deduct this depreciation from the construction cost of the property and add the appreciated land value to compute the. The basic way to calculate depreciation is to.

First one can choose the straight line method of. Identify the propertys basis. Originally posted by Joe Wilson.

Add the market value of the land with this price to get the reasonable selling price of the home. The straight line calculation steps are. Here is how to use a property depreciation calculator step-by-step.

Land value is exempt from depreciation because land. This depreciation factor might get null and void if the location is too much in. It provides a couple different methods of depreciation.

Determine the cost of the asset. Separate the cost of land and buildings. You can do it a couple of ways.

Number of years after construction Total useful age of the building 2060 13. Depreciation on real property like an office building begins in the month the building is placed in service. This is called the mid-month convention.

The depreciated value of the property is 1060 ie. Dont just use 20. Depreciation is a method for spreading out deductions for a long-term business asset over several years.

In such cases depreciation is arrived at through the following formula. Determine your asset depreciation method. This depreciation calculator is for calculating the depreciation schedule of an asset.

In most cases when you buy a building.

Example Of A Property With A Good Cash Flow Return Green Label Positive Cash Flow Cash Flow Statement Cash Flow

A Map Of Every Non Disclosure State In The U S And How Real Estate Investors Can Deal With Them Real Estate Investor Real Estate Tips Real Estate Advice

Calculating The Land And Building Value Of Your Rental Property

Successful Tax Appeal Tips Commercial Property Property Tax Tax Reduction

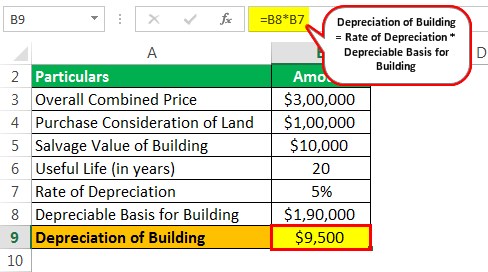

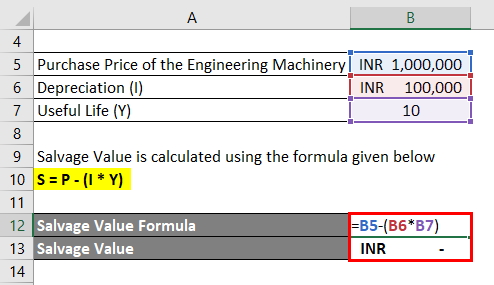

Depreciation Of Building Definition Examples How To Calculate

How To Use Rental Property Depreciation To Your Advantage

Definition Of Net Present Value Financial Calculators Financial Education Financial Problems

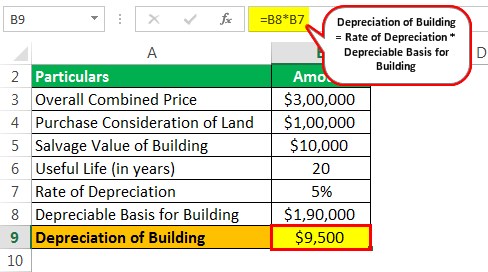

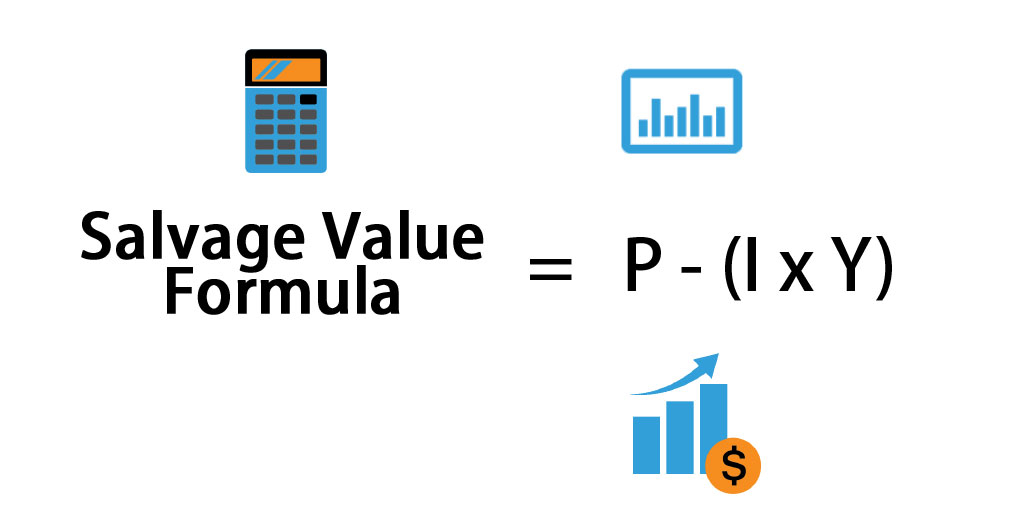

Salvage Value Formula Calculator Excel Template

Depreciation Formula Calculate Depreciation Expense

3 Reasons Why Is Property Tax So High In Texas Property Tax Tax Reduction Commercial Property

How To Calculate Depreciation On Rental Property

Salvage Value Accounting Formula And Example Calculation Excel Template

Salvage Value Formula Calculator Excel Template

How To Calculate Depreciation Expense

Auto Finance Calculator With Trade Fresh Car Depreciation Calculator Calculate Straightline Car Payment Calculator Car Payment Car Loan Calculator

Depreciation Formula Calculate Depreciation Expense

How To Calculate Land Value For Taxes And Depreciation Accounting Marketing Calendar Template Financial Wellness